Navendra Singh, a medical representative, sought tax-saving investment avenues from his friend, who recommended a financial technology portal that laid out the best-performing schemes based on past performances. In the next three years, the schemes saved taxes, but the investments drew a blank. Singh is among the many disappointed investors who are now looking at niche products to boost their portfolios. Aggressive sales push by mutual funds and distributors to earn the extra money have also aided their popularity.

In recent times, niche or theme-based equity products such as multi-asset funds and exchange-traded funds (ETFs) based on smart-beta strategy, environment social governance (ESG) and special situations have been launched.

A senior fund manager on the condition of anonymity explains, “Fund houses launch niche products because there is no cap on launching niche or thematic products. Besides, the idea behind the launch of these products is to shore up assets under management.” It is important to understand what triggers the launch of such niche products. A certified financial planner, who wished to be unnamed, said niche products cash in on trends in markets.

For instance, in the case of multi-asset schemes, fund houses added international funds and commodities to the existing mix of equities and debt. Even performance of these products is not too encouraging.

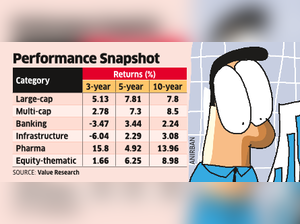

A look at the returns data on some thematic schemes proves this observation. In case of infrastructure funds, the average return has been 2.29% and 3.08% in the past five-year and ten-year periods, respectively. This is lower than the returns of fixed deposits. Also, inflows in thematic funds in the past one year have been ₹3,306 crore. This is the third lowest inflows after dividend and value funds.

Rupesh Bhansali, head–mutual funds at GEPL Capital, said, “Among retail investors some are savvy. But there are a large number of retail investors who do not understand niche products. They should focus more on basic equity products which provide reasonably good returns in the long term.”

Harshvardhan Roongta, CFP, Roongta Securities, said niche products are mostly offshoots of plain vanilla equity schemes. “Retail investors must realise that if they invest in basic equity funds such as large-cap, large-and-mid-cap or multi-cap schemes, they cover a large number of profitable ideas in equities. Niche products, many a time, may be a duplication of these schemes.”

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times