In a social democracy, an important objective of government policy is distributive justice. Growth has to be inclusive, which provides the rationale for redistributive programmes. This redistribution can happen within the framework of capitalism and, by no means, amounts to socialism.

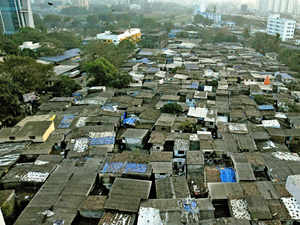

The emphasis on poverty reduction programmes is a natural outcome of electoral competition in a democracy. Around 20 per cent of India’s population is below the poverty line, while 31 per cent has a monthly household income below Rs 12,000, the threshold used in Congress’ proposed Nyuntam Aay Yojana (NYAY).

No political party in India’s democracy can hope to win an election by ignoring the welfare of this group representing almost a third of the population. Major parties compete for their votes, as these voters are too poor to have the luxury of being committed to any political ideology. They are, therefore, the most likely to be moved by policy platforms impacting their economic well-being.

Get to the Bottom

So, no economist providing policy prescriptions can ignore the political constraint of the inevitability of redistribution to the bottom 20-30 per cent . Therefore, an important task before any policy economist is to suggest the most efficient form of this redistribution — one that hurts the rest of the society the least. Of course, it also has to be fiscally viable and responsible.

72 years since Independence, it’s crystal clear that India’s public sector is not competent at delivering goods and services to the poor. Important drivers of its inefficiency are leakages, corruption and lack of accountability of local government functionaries running the poverty programmes. One example is the public distribution system (PDS), where matters are made worse by the fiscal costs of procuring food grains at high prices from farmers and distributing them to fair-price shops to be sold to the poor at very low prices.

Large parts of PDS food grains are often siphoned off to the open market at a higher price. And, often, richer families obtain a below-poverty-line (BPL) card to buy food grains at low prices meant only for the poor. Many poor families, on the other hand, are not able to procure their BPL cards.

The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) scheme, however, has been successful in many respects, providing additional rural employment, including significantly to women and scheduled castes and tribes, along with a self-selection process due to the hard labour needed to participate in it.

However, there have been numerous complaints about delayed and partial payments to workers, money for material not spent, low quality of assets created, etc.

Replacing the above programmes with cash transfers (CTs) will considerably enhance the efficiency of redistribution, and place markets at the helm. Markets normally perform a much better job than bureaucrats in allocating resources and channelling goods and services where they are needed the most. While the government will provide CTs, the provision of goods and services (to be bought with that cash) will have to be by the private sector, or a mix of mutually competing private and public sector providers.

Of course, correctly identifying poor households is difficult. So, a universal CT, such as the universal basic income (UBI), has often been suggested. In his 2016 book, India’s Long Road: The Search for Prosperity, Vijay Joshi suggests that a reasonable amount of UBI can be fiscally viable. If people have to physically stand in line to biometrically authenticate and activate transfer payments to their bank accounts using their Aadhaar cards each month, the number of people requesting a transfer — viewed as too small by the financially secure — could fall by up to 50 per cent .

Cash Course

Jagdish Bhagwati and Arvind Panagariya in their 2013 book, Why Growth Matters: How Economic Growth in India Reduced Poverty and the Lessons for Other Developing Countries, however, support targeted, but unconditional, transfers to the poor (with exceptions of school vouchers, with the child’s name on each, and health insurance for the poor, with premiums paid by the government). For targeting, they suggest using ‘exclusion restrictions’ based on information on ownership of assets such as cars, scooters, land and other kinds of property that have to be registered with the government by law.

I believe that a combination of monthly biometric authentication and ‘exclusion restrictions’ can work well in weeding out the non-poor from receiving CTs. ‘Conditionality’ can result in corrupt practices like fake receipts or invoices, and limit flexibility, freedom of choice and variety.

With over 300 mn bank accounts created under the Jan Dhan scheme, CTs can be made electronically, considerably reducing the likelihood of illegal or ghost recipients. Of course, these have to be supplemented by nutrition education campaigns.

These CTs can be financially viable only if some important conditions are met. First, they need to eventually replace all inefficient subsidy programmes for the poor, including those effectively benefiting mainly the middle class. At least the growth of these programmes should be halted.

Second, India needs to keep growing at 7-8 per cent, so that tax revenues keep doubling every seven years or so, making steady expansion of CTs possible. Finally, these CTs have to initially start much smaller and at a considerably lower maximum threshold than what NYAY proposes, and then grow as the economy grows.

(The writer is Cramer professor of global affairs, Maxwell School of Citizenship and Public Affairs, Syracuse University, US)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the ET ePaper online.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the ET ePaper online.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times