BENGALURU:

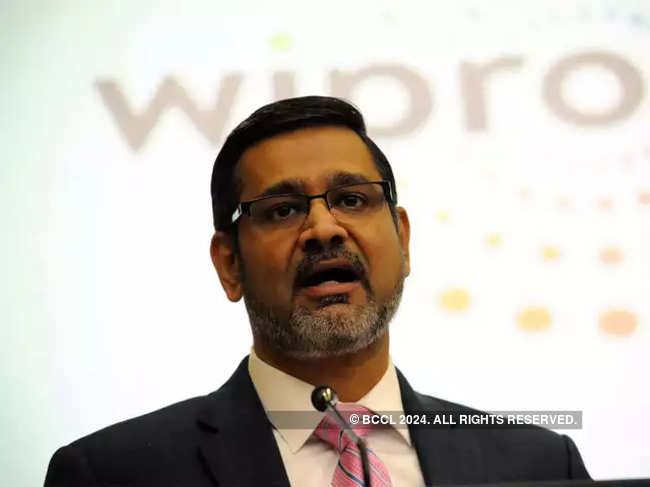

Wipro is adding more small banks as clients in the United States, where large lenders and financial institutions are reducing technology spending due to economic uncertainty, helping the Indian IT firm gain market share, CEO Abidali Neemuchwala told ET. In the quarter to September, Wipro saw its largest client, a bank, cut discretionary spending on technology projects due to lower interest rates and is unlikely to revive it till next year.

“There are some macro trends which will always impact the sector. There is always a micro inside a macro. If you look at our consumer business, it did very well. Sometimes, we over-emphasise on the macro,” Neemuchwala said. “Large banks may be impacted, but if you go to smaller banks, you might win three-four deals”. The Bengaluru-headquartered company saw growth from its top 10 clients — many of whom are from the BFSI sector — declining for the first time in many quarters.

Elevate Your Tech Prowess with High-Value Skill Courses

| Offering College | Course | Website |

|---|

| IIT Delhi | IITD Certificate Programme in Data Science & Machine Learning | Visit |

| MIT | MIT Technology Leadership and Innovation | Visit |

| Indian School of Business | ISB Professional Certificate in Product Management | Visit |

Wipro attributed the drop to completion of some of the digital transformation projects and short-term projects. The focus on smaller, nimble banks that are investing in technology to gain marketshare is helping Wipro. “We are also acquiring a lot of new customers and gaining market share. Just in BFSI segment our percentage of revenue has gone up by 4-5 percentage points in the last three years. ...Our objective is to increase the revenue per customer,” added Neemuchwala. The company said the uncertainties in the

banking and capital markets sectors persist as many large clients remain watchful. Wipro’s rivals TCS and

Infosys have cautioned about uncertainties owing to delay in technology spending by large banks.

Analysts said the delay in renewal project ramp ups may impact the banking segment business but “the guidance looks good for a seasonally weak quarter”.

“Wipro management has a cautious stance on the trajectory of banking and financial services segment. A delay in both digital projects renewal and ramp up of new projects in top client could impact banking growth in the near term,” wrote Devang Bhatt and Deepti Tayal of ICICI Research Direct.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times