The talks are for Sical’s assets in Ennore’s Kamarajar Port, including dedicated iron ore and coal terminals at the facility, valued at about ?700-800 crore, multiple sources with knowledge of the matter told ET.

Sical, which has net debt of close to ?1,500 crore, aims to reduce this by half through the transaction. The company is also said to be in talks with other strategic investors including Adani Group. However, the Gujarat-based conglomerate denied any such talks.

ICICI Securities is advising Sical, sources said.

DP World declined to comment. Sical didn’t respond to queries.

In an earlier regulatory filing, Sical had said it was looking to divest all strategic assets.

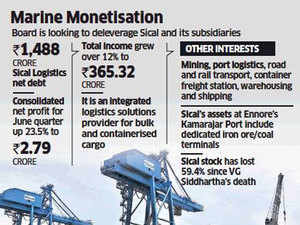

“In wake of the sad demise of our promoter and further to the observations made by the ultimate holding company, that is, Coffee Day Enterprises to deleverage the Coffee Day Group, the board considers it appropriate to come up with a roadmap to deleverage Sical and its subsidiaries,” it said in an exchange notification on August 2. “Accordingly, the board has asked Sical management to explore all the strategic alternatives to possibly deleverage Sical and its subsidiaries. In this direction, the management will come back to the board with its recommendations.”

The terminal was originally meant for iron ore exports but, following a Supreme Court ban, it had to be modified to handle other commodities such as coal. The group is believed to have invested a little over Rs 1,000 crore capital expenditure on the asset, said executives aware of the matter.

Sical has net debt of Rs 1,488 crore, according to a disclosure made by Coffee Day Enterprises on August 19.

The Coffee Day Group acquired a majority stake in Sical from previous promoters, the MA Chidambaram Group, in September 2011. Tanglin Retail Reality Developments, part of the group, has a 50.2% stake in the logistics and supply chain solutions company. Giri Vidyuth (India) holds a 4.99% stake while Siddhartha personally held 0.68%.

The company is an integrated logistics solutions provider for bulk and containerised cargo and has interests in mining, port logistics, road and rail transport, container freight station, warehousing and shipping among others.

Net profit, on a consolidated basis, for the quarter ended June 30, grew 23.5% to Rs 2.79 crore from Rs 2.26 crore in the year earlier. Total income grew over 12% to Rs 365.32 crore from Rs 324.78 crore.

DP World is a global port operator with a portfolio of 78 operating marine and inland terminals supported by over 50 related businesses in over 40 countries across six continents.

The company is building an integrated logistics platform in India. Its Nhava Sheva International Container Terminal (NSICT) is part of India’s largest port, JNPT, which handles 40% of total maritime trade.

“Till FY2019, the promoters had infused ?281 crore of unsecured loans towards various debt repayments and capital expenditure requirements and additional support from the promoter group was expected to continue if the cash flows from Sical were inadequate to meet its debt servicing and capex requirements,” ratings agency ICRA said in a note earlier this month.

“However, the financial flexibility of the group has weakened significantly following the aforementioned development and subsequent steep decline in share prices of group listed entities, including Sical, since a large portion of group loans was backed by personal guarantee of promoter and pledge of listed and unlisted group entities,” it said.

Sical rose 4.2% on Friday, having lost 59.4% in since Siddhartha’s unexpected death.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times