Advent will pick up a minority stake in Tredence, the company said in a statement.

The capital infusion comes at a time when tech startups globally are facing a funding crunch.

Most homegrown data analytics startups that deploy data science across customer experience (CX) and sales and marketing get the lion’s share of their business from the United States. These startups rely heavily on services-based revenues.

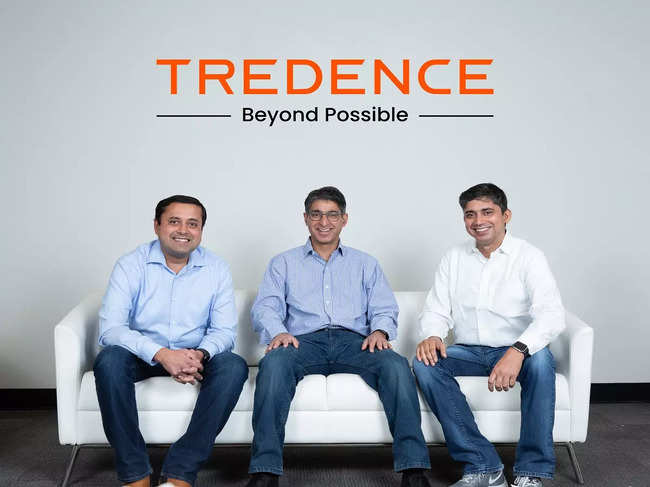

San Jose-based Tredence was founded in 2013 by Bhowmick, Sumit Mehra and Shashank Dubey to provide actionable insights to clients, with data visualisation, data management, advanced analytics, Big Data and machine learning capabilities.

Discover the stories of your interest

Over 80% of Tredence's revenues come from North America, Bhowmick said.

The startup had previously raised $30 million from PE firm Chicago Pacific Partners at a $100 million valuation, ET reported in December 2020.

Advent’s track record

Advent, founded in 1984, has invested in NielsenIQ, Sophos Solutions and QuEST Global Services.

It has over 390 PE investments across 41 countries and had $75.9 billion in assets under management as of FY22.

“Advent’s global reach, deep sector expertise, and vast experience in scaling businesses like ours through organic and inorganic growth will be invaluable to us as we look to drive continued business innovation,” Bhowmick, and IIT-BHU alum who has worked at Britannia Industries, Infosys and Mu Sigma, said.

Tredence employs over 1,800 people and has offices in San Jose, Chicago, London, Toronto and Bengaluru.

Its clients include large companies in the retail, Consumer Packaged Goods, hi-tech, telecom, healthcare, travel, and industrial sectors.

“Data analytics is an exciting segment within digital IT services, with secular growth. The practice is fuelled by the rise in data created and captured globally, the reduced cost of computing and storage, and the opportunity for enterprises to tap into valuable insights to drive competitive advantage,” said Shweta Jalan, managing partner at Advent International.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times